RETIREMENT FUND ANALYSER

We would all like to retire as soon as possible, so that we can do all the things that we never had time for while we were working. But how can you tell if you have enough saved up to retire?

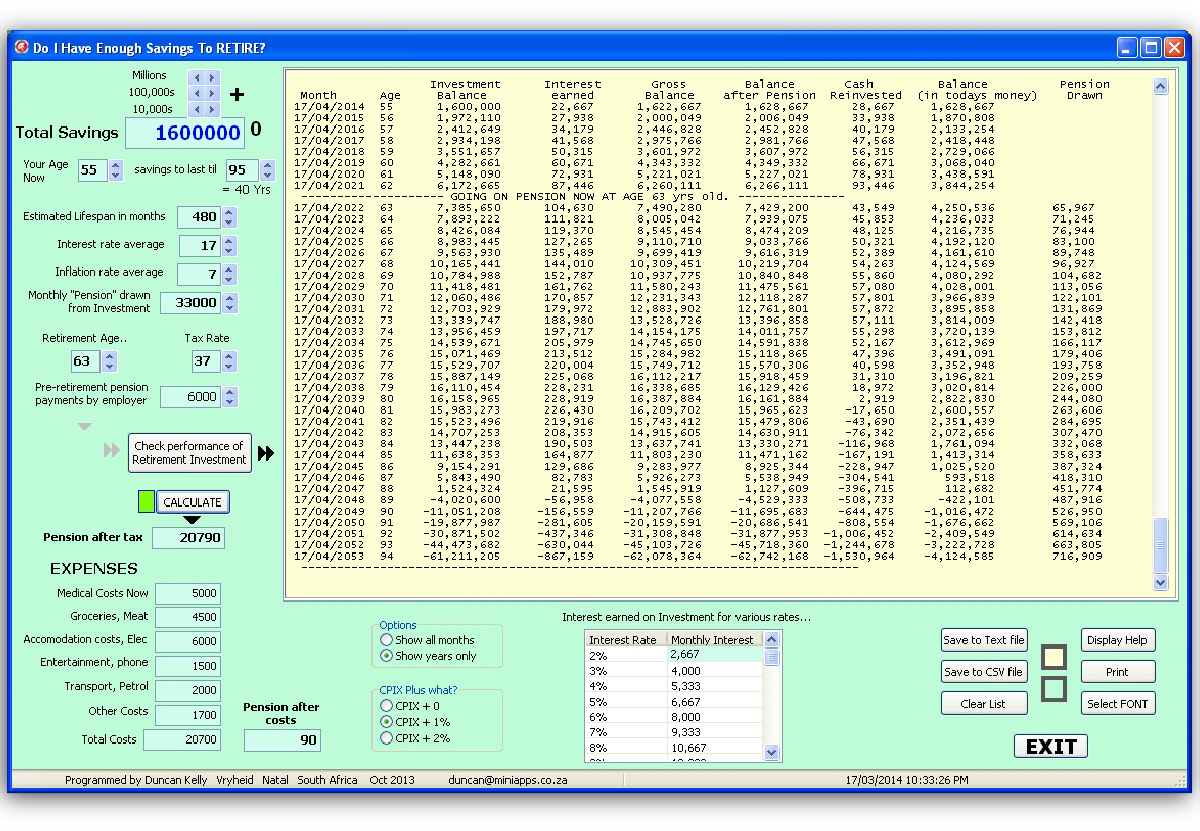

This app works out whether you can retire early or not, and helps you to gauge what standard of living you will have after retirement. You can get an idea of what you will be able to draw each month from your investments without running out of money, and you can keep track of how your investments are likely to grow into the future.

IMPORTANT APPLICATION NOTES :

Quick Start Guide:

1. Enter your total savings/investment in the top box.

2. Enter your current age and the age that you think you'll live to.

3. The lifespan in months should already have the right amount of months -

4. Enter your estimate of what the average yearly interest rate will be over the lifespan you have entered.

5. Enter your estimate of what the yearly inflation rate will be over that lifespan.

6. Enter the monthly amount you intend to draw from your investments once you have

retired. Calculate this amount in todays money -

7. Enter your intended retirement age.

8. Enter your estimated tax rate based on the Monthly pension figure you entered in step 6.

9. If you are not yet retired, enter the amount that your employer pays into your retirement fund each month, otherwise leave it at zero.

10. Click the Calculate button to see what your pension will be after tax (in today's money)

11. Click the "Check performance of retirement investment" button to give a listing of how your retirement savings grow (or last) over the lifespan you have selected.

Change various settings to your preferred likings, like retiring early, drawing more (or less) per month, and then click the "Check performance.." button again to see if your savings will dry up or grow.

Disclaimer: This application is only a guide to help visualise approximate performance of retirement investments. Please always consult a professional, independant advisor before making any investment decisions.

When using financial advisors, rather use an independant advisor that is not attached

to the institution(s) where you intend investing. The advisor must not stand to gain

anything except his fee for his service -

OTHER NOTES:

The amount of your "pension" that you select will be increased annually by a percentage equal to the inflation rate plus 1% (ie. CPIX +1)

Pension Drawn column is the monthly pension that you take out to live on, like a salary.

Click the calculate button to fill the table beneath it and work out pension after tax.

Cash reinvested is how much of your investment return (ie interest) is going back into your investment to create growth to counter inflation losses.

Click the button below this note window to get a listing of how your investment performs.

Remember that interest rates, inflation and tax rates can vary significantly and randomly over long periods of time.

Change the retirement age and then click check performance button to see the difference that a few years makes to your investment.

Try different "monthly pension" amounts to find out how it can lengthen or shorten the time that your money grows.

The green square next to the calculate button will go red when you make a change

to other relevant info -

The two coloured squares on the right can be clicked to change the background colour of the whole app, and the background colour of your results window.

AUTHOR:

Duncan Kelly

Diploma in Datametrics cum laude (UNISA )

MCSE (Microsoft Certified Systems Engineer)

© MiniApps 2013

www.miniapps.co.za duncan@miniapps.co.za

Click here..